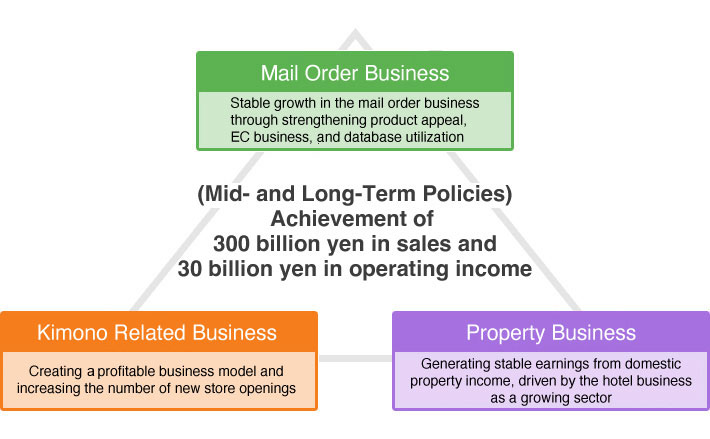

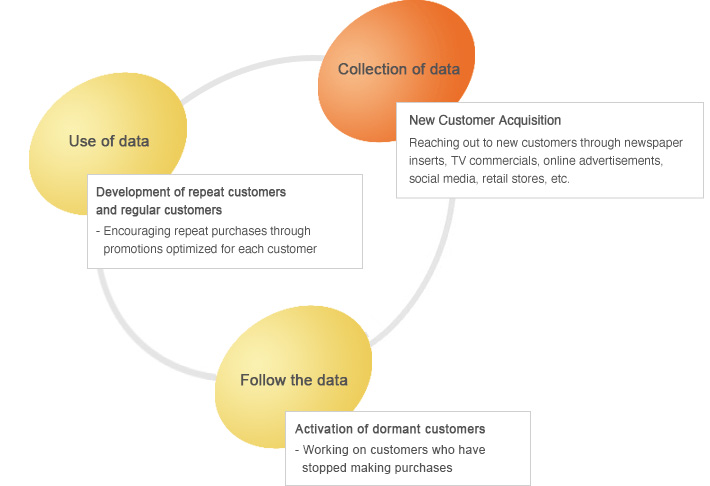

Belluna has grown by harnessing the vast database and other management resources cultivated through mail order sales and various incidental services to branch out into new business areas, in line with its corporate philosophy of “enriching customers’ lives through food, clothing, lifestyle and recreational goods and services.”

Going forward, we will continue to evolve, creating new added value through our multifaceted approach.

In light of the external environment including the reduced impact of COVID-19 pandemic, the ongoing depreciation of Japanese yen, and soaring prices of raw materials, we aim for regrowth by creating a new winning pattern through product value improvements and branding.

For the fiscal year ending March 31, 2025, we target to achieve net sales of 202 billion yen and operating income of 17 billion yen.

We aim for growth through synergies between BANKAN WAMONOYA with its highly profitable business model and the Sagami Group with its strong brand recognition.

For the fiscal year ending March 31, 2025, we target to achieve net sales of 31 billion yen and operating income of 2.1 billion yen.

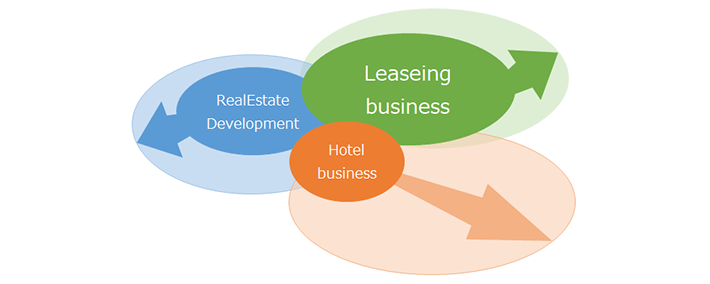

We aim for stable growth in the highly profitable domestic property leasing business as well as substantial growth in the post-COVID hotel business.

For the fiscal year ending March 31, 2025, we target to achieve net sales of 22 billion yen and operating income of 3.1 billion yen.

| 2023/3 | 2024/3 | 2025/3 | |

| Net Sales | 219.0 bil yen | 239.0 bil yen | 261.0 bil yen |

| Operating income (Income on net sales) |

15.0 bil yen (6.8%) | 19.0 bil yen (7.9%) | 22.6 bil yen (8.6%) |