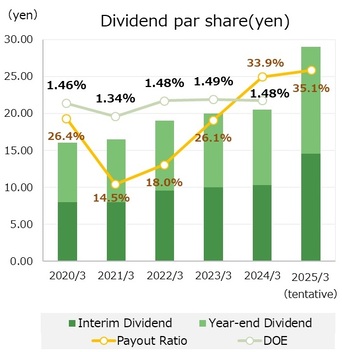

Repaying shareholders for their constant support by making ongoing efforts to increase the corporate value of the Company is one of Belluna’s most important policies. We pay dividends twice a year, with shareholders of record as of September 30 and March 31 receiving interim dividends and year-end dividends commensurate with their shareholding.

Our basic policy of dividends is to pursue a consolidated dividend payout ratio of 35%, with a minimum dividend on equity ratio (DOE) of 1.5%. We will strive to improve the stability of dividends by using DOE as an indicator, which is less susceptible to the effects of single-year business performance.

We also view the acquisition of treasury stock as part of our strategy to return profits to our shareholders, and will consider its implementation as appropriate with the aim to improve capital efficiency.

*The contract date is five business days before March 31 and four business days before September 30.

Regarding dividends for fiscal 2024, we plan to pay a total annual dividend of 20.50 yen per share, comprising an interim dividend of 10.25 yen per share and a year-end dividend of 10.25 yen per share. Taking into account business performance and strategic investments for medium-term growth, the Company will strive to continually pay stable dividends.

Dividend per share(yen) |

Payout Ratio | DOE | |||

Interim Dividend |

Year-end Dividend |

Annual Dividend |

|||

2020/3 |

8.00 |

8.00 |

16.00 |

26.4% |

1.46% |

2021/3 |

8.00 |

8.50 |

16.50 |

14.5% |

1.34% |

2022/3 |

9.50 |

9.50 |

19.00 |

18.0% |

1.48% |

2023/3 |

10.00 |

10.00 |

20.00 |

26.1% |

1.49% |

2024/3 |

10.25 |

10.25 |

20.50 |

33.9% |

1.48% |

2025/3(tentative) |

14.50 |

14.50 |

29.00 |

35.1% |

- |

*The Company implemented a 2-for-1 stock split for its common stock, effective October 1, 2013. The above amounts of cash dividends per share have been adjusted based on the assumption that the stock split was executed at the beginning of the year ended March 31, 2014.