| Item | 2020/3 | 2021/3 | 2022/3 | 2023/3 | 2024/3 | ||

| Scale | Total Assets | 223,128 | 240,211 | 254,178 | 285,592 | 300,691 | |

| Total Fixed Assets | 119,445 | 124,677 | 136,045 | 162,928 | 170,730 | ||

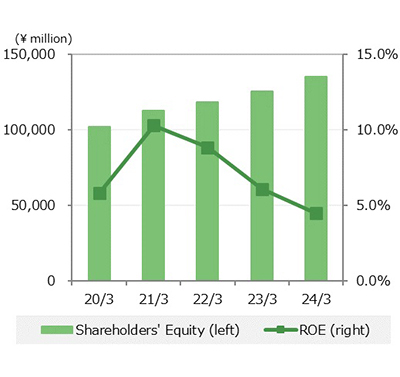

| Shareholders' Equity | 101,889 | 112,620 | 118,269 | 125,496 | 135,191 | ||

| Profitability | Gross Income on Net Sales | 58.4% | 58.9% | 58.7% | 59.2% | 60.7% | |

| Return on Net Sales | *1 | 3.3% | 5.3% | 4.6% | 3.5% | 2.8% | |

| Selling and General Expenses on Net Sales | *2 | 52.7% | 51.2% | 52.5% | 53.9% | 56.0% | |

| ROE | *3 | 5.8% | 10.3% | 8.8% | 6.1% | 4.5% | |

| ROA | *4 | 4.9% | 7.1% | 5.8% | 4.3% | 3.7% |

| Item | 2020/3 | 2021/3 | 2022/3 | 2023/3 | 2024/3 | ||

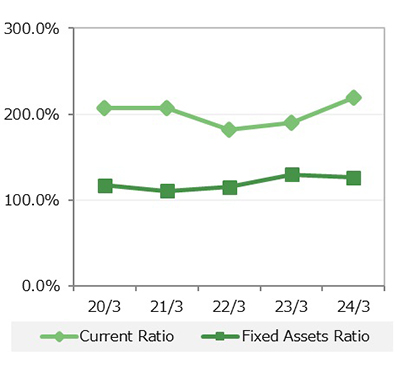

| Stability | Current Ratio | *5 | 206.8% | 207.6% | 182.0% | 189.9% | 219.5% |

| Fixed Assets Ratio | *6 | 117.2% | 110.7% | 115.0% | 129.8% | 126.3% | |

| Long-term Conformity Ratio | *7 | 69.3% | 67.8% | 72.2% | 74.0% | 71.0% | |

| Shareholders' Equity Ratio | *8 | 45.7% | 46.9% | 46.5% | 43.9% | 45.0% | |

| Step Current Ratio | *9 | 1.4 | 1.8 | 1.6 | 1.8 | 2.1 | |

| Debt Ratio | *10 | 30.4% | 26.1% | 28.9% | 37.0% | 37.1% |

| Item | Unit | 2020/3 | 2021/3 | 2022/3 | 2023/3 | 2024/3 | ||

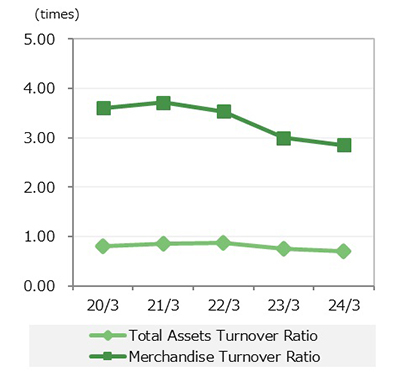

| Efficiency | Total Assets Turnover Ratio | times | *11 | 0.8 | 0.9 | 0.9 | 0.7 | 0.7 |

| Merchandise Turnover Ratio | times | *12 | 3.6 | 3.7 | 3.5 | 3.0 | 2.8 |

| Item | Unit | 2020/3 | 2021/3 | 2022/3 | 2023/3 | 2024/3 | ||

| Productivity | Productivity of Assets | *13 | 47.1% | 50.6% | 50.9% | 44.0% | 42.0% | |

| Productivity of Labor | million yen | *14 | 18.8 | 21.6 | 20.8 | 20.4 | 18.6 | |

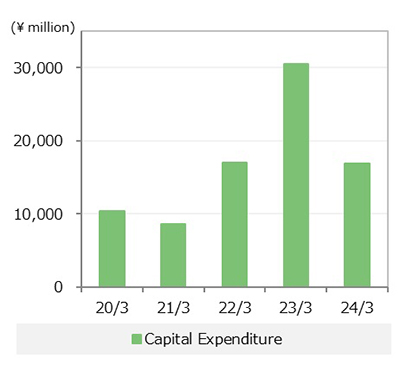

| Others | Capital Expenditure | million yen | 10,342 | 8,596 | 17,046 | 30,489 | 16,933 | |

| Number of Shares Outstanding | thousand shares | 97,244 | 97,244 | 97,244 | 97,244 | 97,244 | ||

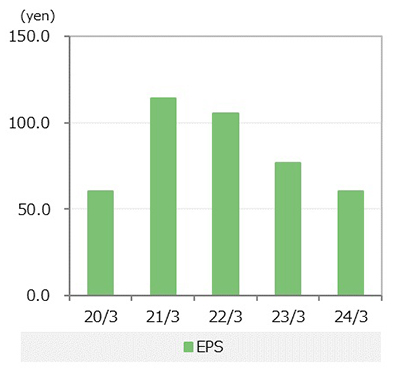

| EPS | yen | 60.6 | 114.2 | 105.6 | 76.7 | 60.4 | ||

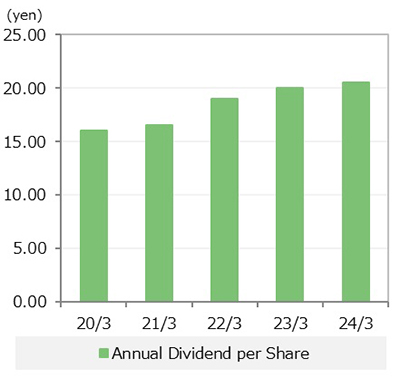

| Annual Dividends per Share | yen | 16.00 | 16.50 | 19.00 | 20.00 | 20.50 | ||

| Net Assets Per Share | yen | 1,054.1 | 1,165.0 | 1,223.2 | 1,297.9 | 1,398.1 |